What a good year for the investors in Indian equities this year-2021 has been! The benchmark Nifty 50 has gained over 24% and Sensex around 22%. Also, on August 31, 2021, the total market capitalization of BSE-listed companies crossed Rs 250 lakh crore for the first time! But what is the 2022 Stock Market Outlook?

This year pandemic developments have been the market’s main driver that caused a crash in 2020 and then a sustained rally due to vaccination programs that allowed the economy to reopen. But now, world stock indexes can see worries over the omicron variant.

So, in today’s blog, let us discuss the journey of the Indian stock market 2021 and 2022 Stock Market Outlook:

The Performance of Indian Stock Market 2021

Let us see how the Nifty 50 performed this year from the chart below:

1. Performance of World Indices

Nifty also outperformed its global peers as the index gained about 23.3% year-to-date except for France’s CAC 40, which gained 28.1% as on 29.12.2021

2. Sectoral Performance

Let us see the Sectoral Performance in 2021:

As we can see from the chart below, the Nifty Metal index has outperformed among the sectoral indices, with a strong surge of about 72% in 2021 as of 29.12.2021. Nifty Pharma and FMCG has been a laggard with gains of just 8.4%

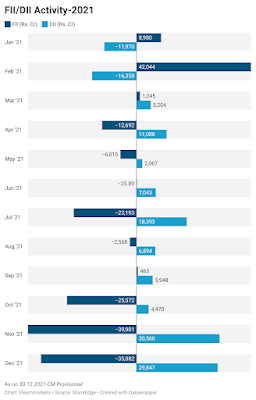

3. FIIs Vs. DIIs in 2021

The foreign inflows moved the markets higher till February, but domestic institutional investors came to the rescue after the end of the second wave of Covid-19. Due to faster withdrawal of monetary stimulus and also the Omicron strain, the DIIs kept the markets moving, undeterred by the FII outflows.

4. Initial Public Offerings 2021

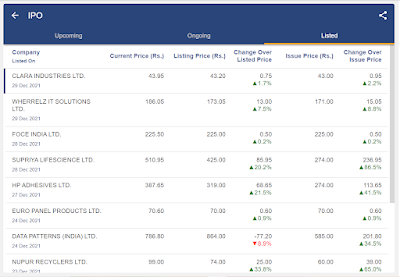

2021 has been the year of Initial Public Offerings! There were around 63 IPOs listed in the Indian Stock Exchange that raised the amount of Rs. 119,882 crores and some of them where IPOs were successful. Also IPOs of New-age businesses like Paytm, Nykaa and Zomato Ltd. made their market debut. Also, 15 of these IPOs offered up to 300% to the investors.

You can check the listed IPOs from the IPO section of StockEdge as shown below:

2022 Stock Market Outlook

As we move ahead to the year 2022, the main key drivers for this new year will be Covid, inflation, and prolonged supply chain issues that could cause pressure on global trade and growth.

Also, if things go right then 2022 maybe another year of IPOs. Yes! You heard it right. One of the biggest IPOs- LIC may debut sometime in March. Also, there are many other companies whose approvals are pending from SEBI for listing in the exchange.

Oravel Stays (OYO) whose papers are still pending with SEBI would be as big as Rs. 84,30 crores and would join IPOs that debuted this year like Paytm, Nykaa, Policybazaar and others that currently got listed on the exchange.

Also, other companies like Emcure Pharma, Adani Wilmar, Go Airlines, Gemini Edibles, India1 Payments, Pradeep Phosphates, Arohan Financial Services and Northern Arc Capital are some of the companies which have already received SEBI approval for public issues.

Bottomline

This year 2021, has been suitable for stock market investors. We hope that the new year 2022 will be as ideal as this year for retail investors. We hope you found this blog informative and use the information to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy.

Happy New Year!

0 Comments

Did you enjoy what you read? Subscribe to our newsletter and get content delivered to you at your fingertips!!